Business Insurance in and around Battle Ground

Searching for coverage for your business? Look no further than State Farm agent Troy McCoy!

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

Small business owners like you have a lot of responsibility. From inventory manager to HR supervisor, you do as much as possible each day to make your business a success. Are you an optometrist, a pharmacist or an acupuncturist? Do you own an art store, an interpreter or a dance school? Whatever you do, State Farm may have small business insurance to cover it.

Searching for coverage for your business? Look no further than State Farm agent Troy McCoy!

Almost 100 years of helping small businesses

Keep Your Business Secure

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Troy McCoy. With an agent like Troy McCoy, your coverage can include great options, such as worker’s compensation, artisan and service contractors and commercial liability umbrella policies.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Troy McCoy's team to learn about the options specifically available to you!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

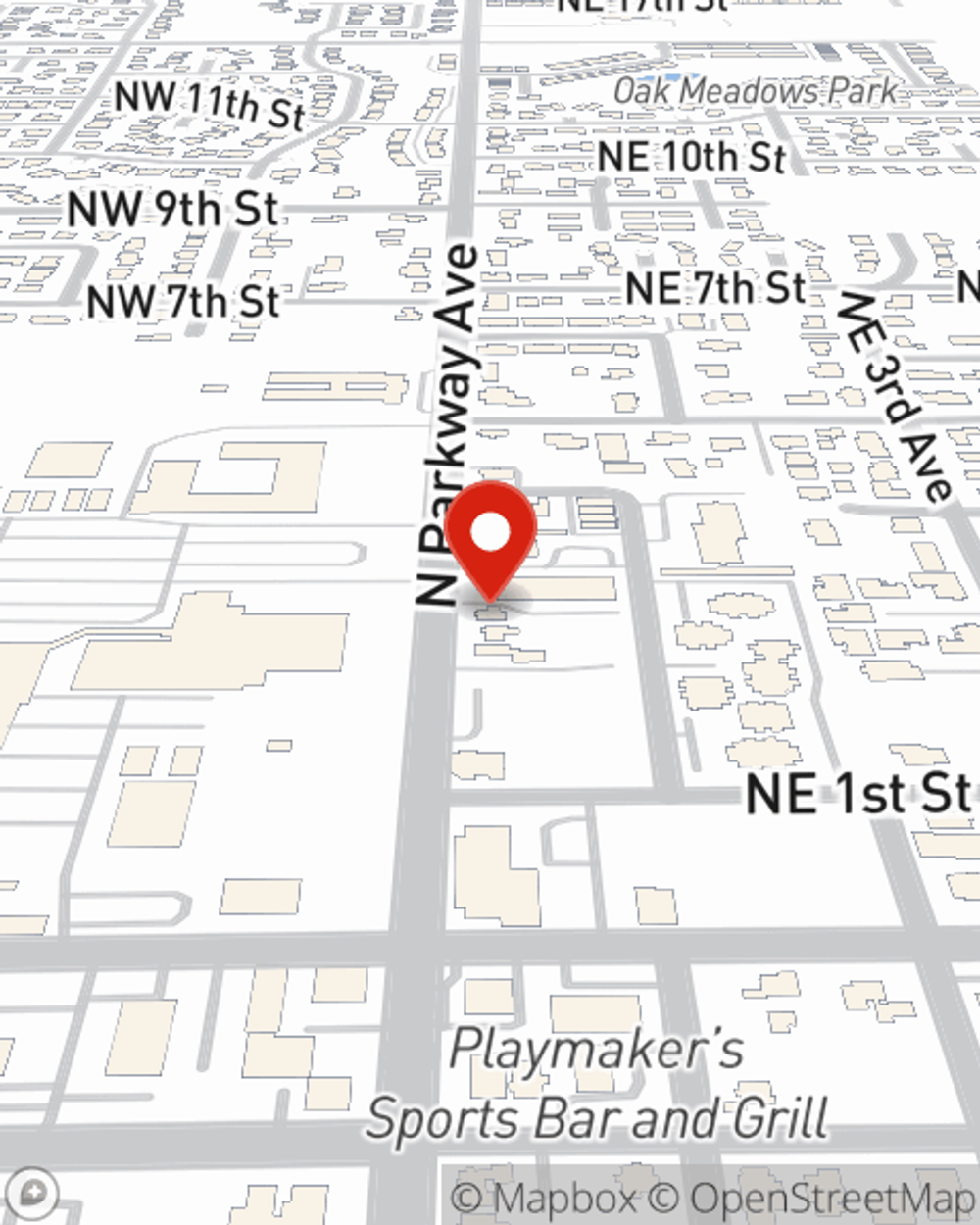

Troy McCoy

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.